The difference between Total Cards, Inc., and MyCCPay is just as of the service provider and product provider. MyCCPay.com is the portal of paying and managing the payments of the credit cards and the Total cards, Inc. will the service through which the work will be done.

There are many cards for people with a low or bad credit limit such as the Secured discover IT cards that will be available at the lower or bad credit score of the consumer.

Login Official OR Feedback Form

If your account is been managed by the MyCCPay then you need to look for credit cards with a lower amount of annual fee.

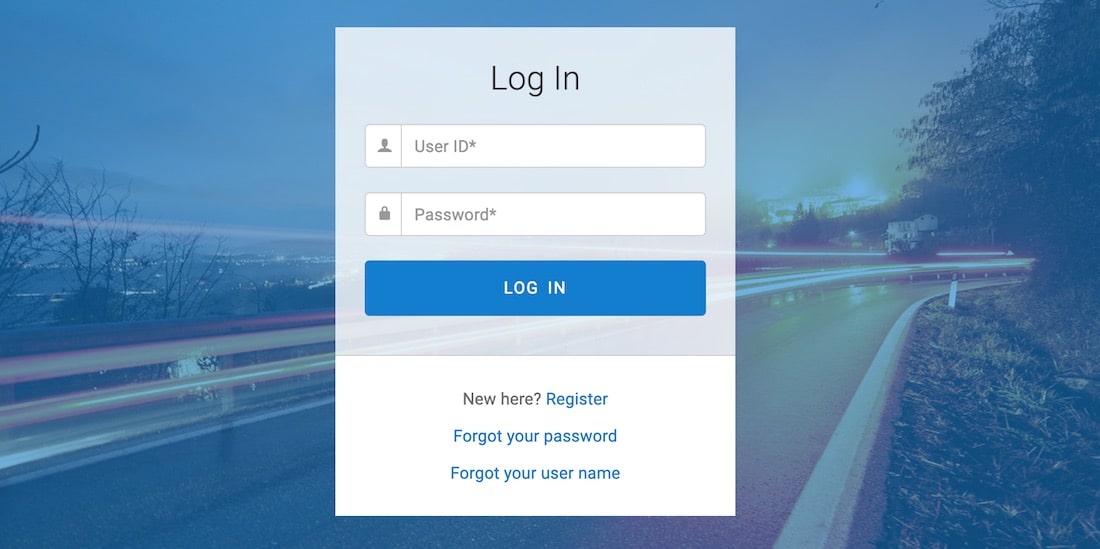

MyCCPay Login / Sign in Procedure

The procedural steps to login into the official portal

- Search MyCCPay on your browser or directly Log in.

- Enter your unique user ID registered with your account.

- Enter the Password that you set with the account while registering with the portal.

Follow the steps to get with the account and manage all your account payments easily.

| Topic | MyCCPay |

|---|---|

| Official Company | Total Card Inc |

| Cards Available | Mastercard, Visa |

| Benefits | Safety Features |

| Toll Free No. | 1‐888-262-2850 |

Recovering the MyCCPay Log In Password

Follow these simple steps to recover your MyCCPay.com account password.

- Search for My CC Pay or click on the direct link of www.myccpay.com

- Enter your 16 digit account number without dashes.

- Enter your 4 digits social security number.

- Enter your zip/postal code.

- A temporary password will be sent to your registered account Email ID with which log back in.

Remember to change the password as soon as you log in with the help of the temporary password. Click on the menu on the top of the homepage, click on settings, go to privacy and settings, and click on change password to set a new password.

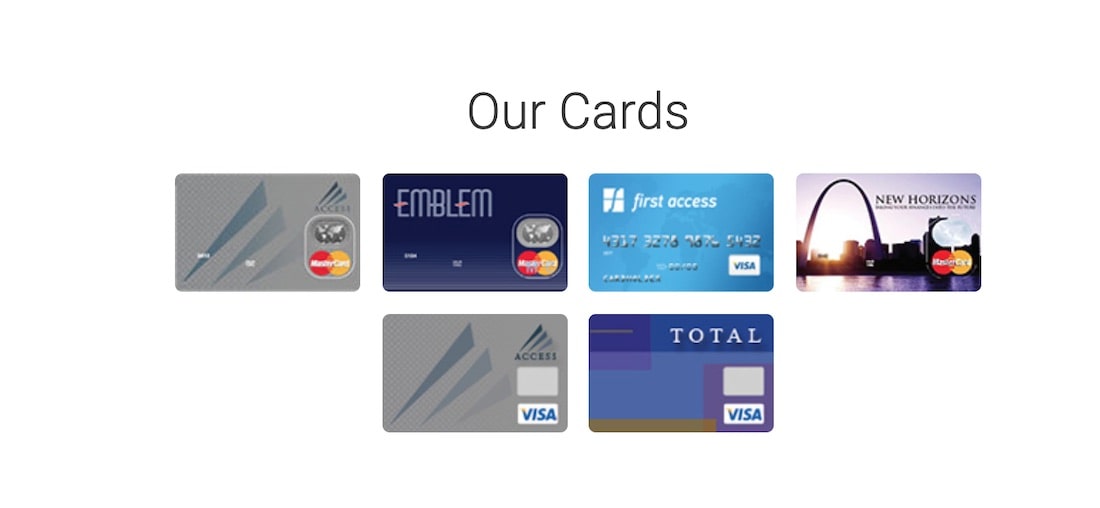

Cards accessible on www.MyCCPay.com

The following list of credit cards are the ones that can be eligible for the MyCCPay to manage payments and get the credit usage properly.

- Access Mastercard.

- First Access Visa card.

- Total Visa card.

- Emblem Mastercard.

- New Horizon Mastercard.

First Access Visa card

The First access Visa card is the card available for those who have a very low limit of credit or to those who have no options but to go for the credit card in any case. So for everyone having a low credit limit choose the option of having First Access Visa card.

The First Access Visa card comes easily available for the ones having a low credit limit but has a huge cost for applying towards it with the cost of $89.99 one time processing fee and an annual fee of services costing up to $75 (the first year costs nothing ). The immediate upgrade towards a better card would be a better option for all the consumers using this card, but this card is eligible for MyCCPay.

Total Visa credit cards

Total visa credit cards are also eligible for the MyCCPay portals but there is not much difference between First access visa cards and total visa cards because they are both having the least credibility limit and both have fee structured that costs a lot.

Emblem, New horizon, and Access credit cards

These cards do not have a very large database of customers and reviews about them because they are the least popular of the cards amongst all cards because of customers not being happy with the service that’s being served to them. Though these cards are also eligible for the MyCCPay portal.

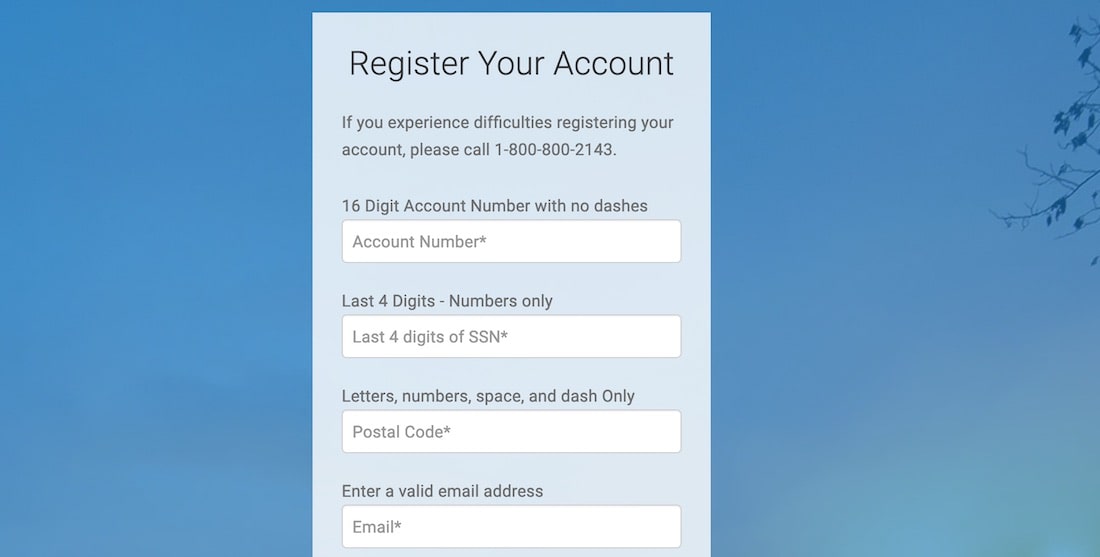

Getting registered with MyCCPay.com

To manage or get a credit limit usage of all the payments made from your credit card get registered with MyCCPay and follow these steps to get registered.

- Search MyCCPay on your browser to register with the portal or tap on Direct registration.

- Enter your 16 digit account number with no dashes in between the numbers.

- Enter your 4 digits Social security number.

- Enter your Email ID that is registered with your account.

- A particular and unique user ID will be registered with you from the portal.

Follow these steps to get your account registered with the MyCCPay and get all the services and management of all the payments made from your credit card.

Alternatives to high fee credit cards

There are many credit cards available to apply for consumers who have a bad credit score and have no credit cards. Credit cards are really important these days for payment of things that cannot be paid in cash. Credit cards are used everywhere and can be used at every place, for e.g. – You want to buy something online, you will definitely need a credit card for the payment method for online payment.

Here are a few structural steps to get an improved credit score.

- Go to a free credit check site like credit karma.

- Pay all your bills on time.

- Contact the companies you owe bills or the companies that your bills due.

- Contact the credit agency and tell them about if you have issues with your credit score.

If the following steps carried out perfectly then you should have a determined credit score, try applying for low fee credit cards.

FAQs About MyCCPay

The following are some answered frequently asked questions

MyCCPay.com is not accepting my card what should I do?

As a Total cards, Inc. company service the above-mentioned cards can only be used for payment management and as of the terms no other cards will be accepted for the payment management. The cards are as following

- First access card

- New horizon visa card

- Access Master card

- Emblem Visa card

- Total Visa credit cards.

Why is my processing fee is not lowering after I improved my credit balance?

- For help and support from MyCCPay.com contact 1‐888-262-2850 for issues that are not resolved simply.

Is there a way to contact the authorities about the dysfunction in the credit limits and scores?

- Yes, you can click on the contact us option on the top of the help and support of the home page and tell them about your issues in details.

When can I manage my payments on the portal?

- The portal is working 24/7 so you don’t have to worry about time, you can pay whenever and wherever you want to.

The above-mentioned is the know-about of MyCCPay login, registration and recover password and all necessary primary information to get with the management of the credit card payments and credit scores.